Rising bonds yields clip stocks; Social Security increase announced for 2024 Wall St. bitten again by riding bond yields

NEW YORK — U.S. stocks slipped Oct. 12 after the clamps tightened again on Wall Street from rising yields in the bond market.

The S&P 500 fell 0.6 percent, the first drop for the broad-based index in five days.

The Dow Jones Industrial Average dropped 0.5 percent Thursday, and the Nasdaq composite sank 0.6 percent.

The stock market has largely been taking its cue from the bond market recently, and weak results announced in the afternoon for an auction of 30-year Treasury bonds sent yields higher on all kinds of government debt. Higher yields can knock down prices for stocks, all else equal, and slow the economy by making borrowing more expensive.

Yields had already been on the rise in the morning following a report that showed inflation at the consumer level was a touch higher last month than economists expected. That raises worries about the Federal Reserve keeping its main interest rate high for a long time, as it tries to drive down inflation.

Social Security checks to rise 3.2% in Jan.

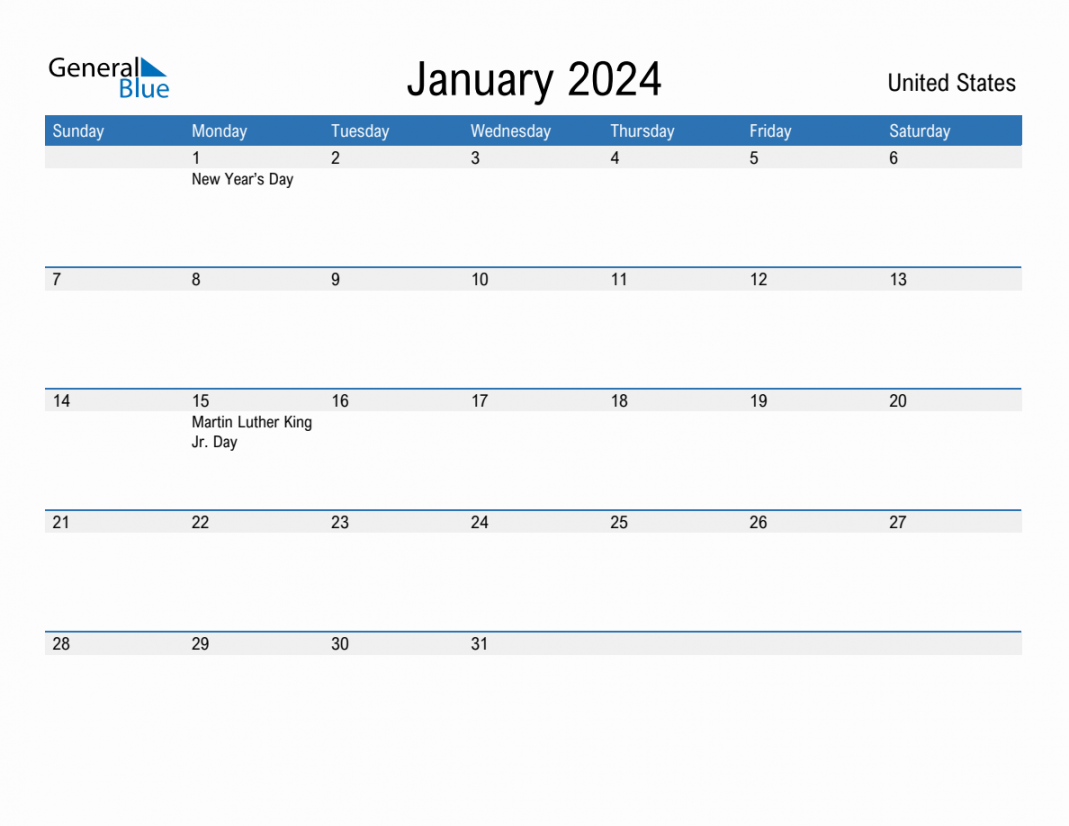

WASHINGTON — Millions of Social Security recipients will get a 3.2 percent increase in their benefits in 2024, far less than this year’s historic boost and reflecting moderating consumer prices.

The cost-of-living adjustment, or COLA, means the average recipient will receive more than $50 more every month beginning in January, the Social Security Administration said Oct. 12. The AARP estimated that increase at $59 per month.

About 71 million people — including retirees, disabled people and children — receive Social Security benefits.

Thursday’s announcement follows this year’s 8.7 percent benefit increase, brought on by record 40-year-high inflation, which pushed up the price of consumer goods. With inflation easing, the next annual increase is markedly smaller. On top of that, an anticipated increase in Medicare premiums for 2024 will eat into the cost-of-living bump.

Medicare hasn’t announced the increase for traditional Medicare, but said the cost of Medicare Advantage plans is expected to remain stable.

US tax debt gap is set to widen further

NEW YORK — The amount of tax money owed but not paid to the IRS is set to keep growing, according to projections published by the federal tax collection agency on Oct. 12.

For tax years 2021 and 2020, the latest annual estimates from the agency, the projected gross “tax gap” soared to $688 billion and $601 billion, respectively. That marks a significant jump compared to years past — with gross tax gap projections standing at $550 billion for 2017-2019 and $496 billion for 2014-2016.

One of the IRS’s biggest challenges is making sure that people actually pay their taxes. While agency data shows that the vast majority of Americans pay their taxes voluntarily and on time, hundreds of billions of dollars in unpaid taxes pile up each year — and tax gap estimates keep getting bigger.

IRS Commissioner Danny Werfel said that the rising tax gap estimates “underscores the importance” of more compliance efforts. Part of the $80 billion the IRS received from the Biden administration’s Inflation Reduction Act is being used for that purpose.

The projected gross tax gap — made up of failed payments through nonfiling, underreporting and underpayments — doesn’t account for late payments or IRS enforcement. In 2021, the IRS expects to bring in $63 billion through late payments and enforcement efforts, bringing the estimated net tax gap to $625 billion.

IRS says Microsoft owes more than $29B

SAN FRANCISCO — The Internal Revenue Service says Microsoft owes the U.S. Treasury $28.9 billion in back taxes, plus penalties and interest, the company revealed Wednesday in a securities filing.

That figure, which Microsoft disputes, stems from a long-running IRS probe into how Microsoft allocated its profits among countries and jurisdictions in the years 2004 to 2013. Critics of that practice, known as transfer pricing, argue that companies frequently use it to minimize their tax burden by reporting lower profits in high-tax countries and higher profits in lower-tax jurisdictions.

Microsoft said it followed IRS rules and will appeal the decision within the agency, a process expected to take several years.

Fla. citrus forecast improves over last year

ORLANDO, Fla. — The forecast for Florida citrus, the state’s signature crop, is expected to improve in the upcoming season compared to last year when twin hurricanes battered the state, according to estimates released Oct. 12.

Florida is expected to produce 20.5 million boxes of oranges during the upcoming season, up from 15.8 million last season, the U.S. Department of Agriculture said.

Growers are expected to harvest 1.9 million boxes of grapefruit during the 2023-2024 season, which lasts through next spring, up from 1.8 million boxes last season.

The production of tangerines and mandarins also was forecast to be up, going from 480,000 boxes last season to an expected 500,000 boxes.

Florida had been the leading U.S. producer of oranges until last season when the state was battered by Hurricanes Ian and Nicole. California then surpassed the Sunshine State.

New Orleans shipyard sale put on hold

NEW ORLEANS — Plans by the Port of South Louisiana to purchase what was once a major New Orleans area shipyard for construction of military vessels have been delayed.

The port announced in January its intent to buy the old Avondale Shipyard site from T. Parker Host. The Times-Picayune/The New Orleans Advocate reported Oct. 11 that the purchase has been put off indefinitely after questions from the state Bond Commission.

Members of the commission, which must approve government debt, had noted that the port had not provided detailed accounts of Host’s revenue at Avondale for previous years as a terminal operator. Host bought the site in 2018, about four years after the shipyard that once employed thousands was shuttered. The proposed sale would require more than $400 million in public financing.

Host bought Avondale for $60 million and said it invested $90 million in the site, primarily to remediate environmental damage and add a new wharf. The company has built up a stevedoring and port operation but hasn’t been able to attract enough large, long-term tenants to fill its 254 acres of industrial space.